A reading of the financial and monetary policies of the International Monetary Fund report - May 2024

articles

Ali Daadoush

Economy News - Baghdad

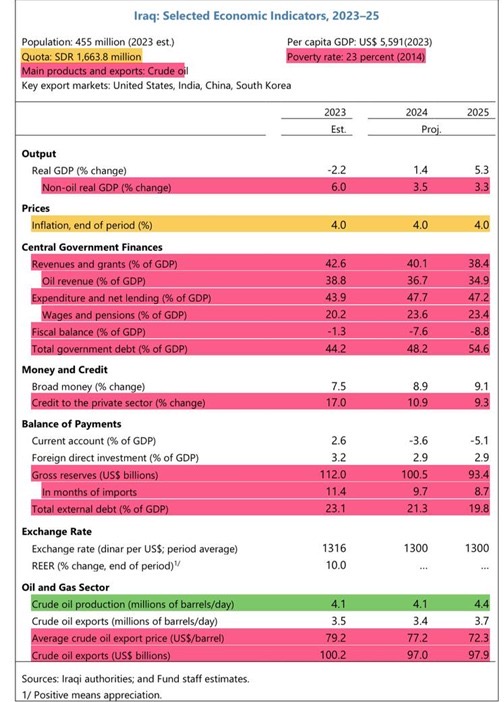

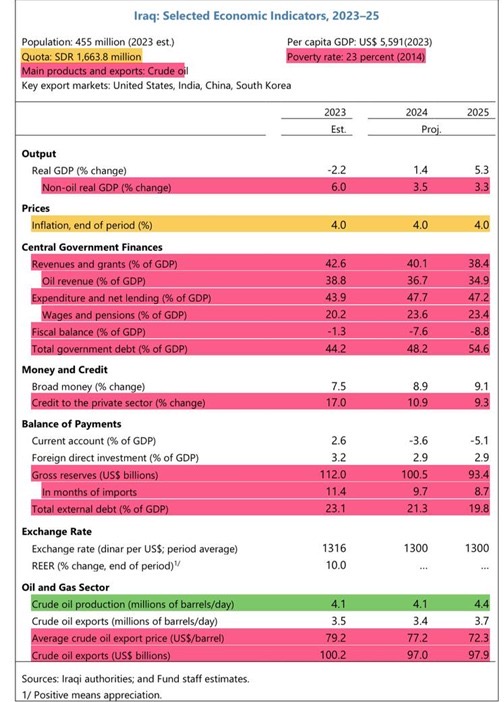

The report showed important data for the Iraqi economy during the period (2020-2023), actual and forecasts for the year 2024, and then predictions of the course of economic policy during the period (2025-2029), and

according to the data of the main table listed below, the data for Special Drawing Rights (SDR), inflation, and crude oil production were stable. To some extent,

but the other data were unstable, and some of them even portend danger in the coming years, especially for financial policy, in which the extent of the government’s intervention in the economy became apparent in terms of large expenditures, specifically the salaries, wages, and retirement sections, as well as the rise in public debt to levels of the danger zone, which are extremely high. (60%) of the gross domestic product.

Although oil output represents about 40% of the real gross domestic product, non-oil output represents only a small portion of total revenues and exports, making Iraq highly vulnerable to fluctuations in oil prices.

Moreover, the public sector wage bill (under increasing pressure from compulsory employment policies) remains the highest in the region.

This challenge is exacerbated by the lack of development in the private sector, which is hampered by factors including a large state footprint, corruption, bureaucracy, underdeveloped infrastructure, and poor access to credit.

Unemployment rates remain high and labor force participation levels are low, especially among youth and women, and although domestic stability has improved, public reforms still lag in key areas.

*The red color indicates a danger facing the Iraqi economy, the

yellow color indicates relative stability, and the

green color indicates economic growth.

First: economic policy discussions

Current policies significantly increase the dependence of the Iraqi economy on oil prices, and

to protect macroeconomic stability and sustainability, there must be financial reform (adjustment) that focuses on controlling the wage bill and mobilizing non-oil tax revenues while protecting vital social and investment needs, and this must be complemented by accelerating structural reforms. To stimulate private sector development, including through labor market reforms, restructuring of state-owned banks (Rafidain and Al-Rasheed in particular) and continued anti-corruption efforts.

Second: Financial policy

The fiscal situation is expected to deteriorate in 2024 and beyond, increasing vulnerabilities, and

although IMF staff expect only partial implementation of the investment budget due to capacity constraints, total government spending is expected to remain increasing by 3.8% of GDP in 2024, of which 3.4% is due to higher salaries and pensions (including transfers to the KRG).

Therefore, the deficit is expected to rise to about 7.6% of GDP in 2024 due to the increase in government expenditures, and

in light of the weakness of non-oil revenues and the continued dependence on oil revenues, it is expected that the fiscal deficit will deepen further under the assumption that there are no changes in fiscal policy,

Which forces the government to rely on cash financing, which means the central bank financing government expenditures in exchange for securities (discounting treasury transfers).

This increases government debt from 44% of GDP at the end of 2023 to more than 86% by 2029, resulting in a high risk signal in the medium term.

Fiscal policy reform requires a number of the following measures, including

(mobilizing non-oil revenues and

restrictions on current expenditures, while

protecting capital investment and perhaps

expanding targeted social transfers).

Provisional return estimates indicate that the following list of measures could provide sufficient savings:

A - The focus of any adjustment strategy should be to find savings in the wage bill.

Savings could start with phasing out mandatory staffing requirements, and could be followed up with an attrition-based strategy to adjust the size of government staffing.

Given the role of public sector employment in the Iraqi social contract and the large existing gender employment gaps, such measures must be gender balanced and supported by labor market reform to expand private sector employment opportunities.

B- It must be a mobilization of additional non-oil revenues.

By removing tax exemptions on profitable state institutions, reforming the salary tax and reviewing customs duties in the near term.

Material increases in revenues can be achieved by making payroll taxes more progressive, subjecting public sector allowances to tax, which can be as large as salaries, and personal income tax being withheld at source.

A review of the customs tariff structure, along with unification of customs regulations with the KRG, and the imposition of new duties (for example, on cigarettes) and sales taxes on luxury goods could also contribute to non-oil revenues.

Targeted technical cooperation in tax policy can help enrich and develop the design of these revenue mobilization measures.

Further improvements in revenue and customs administration could also bring in additional revenue.

The authorities should build on the remarkable progress achieved in the ASYCUDA system trial by expanding its use at other border control points and adjusting customs operations in accordance with the new system.

In the medium term, imposing a general sales tax or value-added tax could boost non-oil revenues.

Third: Monetary policy

The Central Bank of Iraq has resorted to using a tight monetary policy to improve the liquidity management framework, and

further liquidity absorption may be needed to support the monetary policy transition.

In response to the sharp increase in excess liquidity, the central bank raised the policy rate from 4% to about 7.5% and reduced funds for subsidized lending initiatives in mid-2023.

However, the penetration of the policy rate was weak due to excess liquidity and lack of market incentives in financial intermediaries. Especially in government banks.

The reserve requirement was also increased from 15% to 18% and the 14-day CBI billing facility was introduced.

After these measures by the monetary authority, the liquidity surplus decreased initially, but it rose again in August 2023 as a result of the implementation of the general budget,

which means the need for more measures to absorb the liquidity surplus, including improving coordination between fiscal and monetary policy towards achieving The goal of price stability.

As the fiscal policy is expansionary through the huge volume of expenditures, it is offset by a contractionary monetary policy through raising interest rates to confront the surplus liquidity in the economy.

Therefore, consideration can be given to increasing reserve require :heart: ments on government deposits, which will help absorb excess liquidity in government banks without harming private banks.

Organizing and securing correspondent banking relationships is crucial to ensuring an easy transition to the new trade finance system.

The authorities must intensify efforts to modernize the banking sector to facilitate the establishment of correspondent banking relationships.

Trade financing before 2023 was done through financial consolidation, but

after the introduction of the compliance platform, trade financing changed, and the

Iraqi Central Bank pre-financed dollar accounts abroad for local commercial banks that had correspondent banking relationships with Citi Bank for trade financing.

This allowed an increase in the share of cross-border payments settled through commercial banks.

At the beginning of 2025, the Central Bank of Iraq plans to fully transition to a supervisory role in settling cross-border payments (import financing).

To facilitate this transition, the Central Bank of Iraq has assisted private banks in securing correspondent banking relationships, including providing guidance on accrediting and evaluating banks in line with best practices. International.

As of the writing of the article, (6) banks have established correspondent relationships with American banks, and

many others have correspondent banking relationships with non-American banks.

Strengthening these efforts is essential to ensure a successful transition to the new trade finance system.

In addition, monetary policy has achieved an important breakthrough in expanding the scope of digital payments, as

many measures have been taken to promote digital payments, including

expanding the use of point-of-sale devices,

obligating the use of electronic payment cards in certain transactions such as purchasing fuel, and

raising transaction ceilings at ATMs.

Automated bank cards and

reduced bank fees.

These efforts are welcome and will help reduce Iraq's dependence on cash and improve financial inclusion, especially for women whose access to financial services may be restricted due to limited mobility and other obstacles.

Monetary policy also worked to integrate the banking sector, as the

Central Bank took a decision to increase the minimum banking capital requirements from 250 to 400 billion Iraqi dinars.

Banks (many of which are small) will either have to inject more capital or submit an M&A plan by the beginning of 2025, and

careful planning and public communication will be critical to achieving the reform goal of improving the efficiency and competitiveness of the private banking sector without creating a From uncertainty about the banks' viability.

However, the implementation of core banking systems, certification of previous financial statements and amendment of regulations to strengthen the governance of state banks remain weak, and the

slow progress in reforming state banks hampers the effective allocation of credit and transmission of monetary policy.

The authorities must continue to strengthen the AML/CFT framework and its effectiveness, including in the banking sector.

These efforts should be guided by the priority actions emerging from the MENAFATF Mutual Evaluation which will conclude in the third quarter of 2024.

Once key areas for further improvement have been identified, seeking more targeted technical assistance can Helps support these efforts.

views 621 Added 05/17/2024 - 9:59 PM

https://economy-news.net/content.php?id=43504

articles

Ali Daadoush

Economy News - Baghdad

The report showed important data for the Iraqi economy during the period (2020-2023), actual and forecasts for the year 2024, and then predictions of the course of economic policy during the period (2025-2029), and

according to the data of the main table listed below, the data for Special Drawing Rights (SDR), inflation, and crude oil production were stable. To some extent,

but the other data were unstable, and some of them even portend danger in the coming years, especially for financial policy, in which the extent of the government’s intervention in the economy became apparent in terms of large expenditures, specifically the salaries, wages, and retirement sections, as well as the rise in public debt to levels of the danger zone, which are extremely high. (60%) of the gross domestic product.

Although oil output represents about 40% of the real gross domestic product, non-oil output represents only a small portion of total revenues and exports, making Iraq highly vulnerable to fluctuations in oil prices.

Moreover, the public sector wage bill (under increasing pressure from compulsory employment policies) remains the highest in the region.

This challenge is exacerbated by the lack of development in the private sector, which is hampered by factors including a large state footprint, corruption, bureaucracy, underdeveloped infrastructure, and poor access to credit.

Unemployment rates remain high and labor force participation levels are low, especially among youth and women, and although domestic stability has improved, public reforms still lag in key areas.

*The red color indicates a danger facing the Iraqi economy, the

yellow color indicates relative stability, and the

green color indicates economic growth.

First: economic policy discussions

Current policies significantly increase the dependence of the Iraqi economy on oil prices, and

to protect macroeconomic stability and sustainability, there must be financial reform (adjustment) that focuses on controlling the wage bill and mobilizing non-oil tax revenues while protecting vital social and investment needs, and this must be complemented by accelerating structural reforms. To stimulate private sector development, including through labor market reforms, restructuring of state-owned banks (Rafidain and Al-Rasheed in particular) and continued anti-corruption efforts.

Second: Financial policy

The fiscal situation is expected to deteriorate in 2024 and beyond, increasing vulnerabilities, and

although IMF staff expect only partial implementation of the investment budget due to capacity constraints, total government spending is expected to remain increasing by 3.8% of GDP in 2024, of which 3.4% is due to higher salaries and pensions (including transfers to the KRG).

Therefore, the deficit is expected to rise to about 7.6% of GDP in 2024 due to the increase in government expenditures, and

in light of the weakness of non-oil revenues and the continued dependence on oil revenues, it is expected that the fiscal deficit will deepen further under the assumption that there are no changes in fiscal policy,

Which forces the government to rely on cash financing, which means the central bank financing government expenditures in exchange for securities (discounting treasury transfers).

This increases government debt from 44% of GDP at the end of 2023 to more than 86% by 2029, resulting in a high risk signal in the medium term.

Fiscal policy reform requires a number of the following measures, including

(mobilizing non-oil revenues and

restrictions on current expenditures, while

protecting capital investment and perhaps

expanding targeted social transfers).

Provisional return estimates indicate that the following list of measures could provide sufficient savings:

A - The focus of any adjustment strategy should be to find savings in the wage bill.

Savings could start with phasing out mandatory staffing requirements, and could be followed up with an attrition-based strategy to adjust the size of government staffing.

Given the role of public sector employment in the Iraqi social contract and the large existing gender employment gaps, such measures must be gender balanced and supported by labor market reform to expand private sector employment opportunities.

B- It must be a mobilization of additional non-oil revenues.

By removing tax exemptions on profitable state institutions, reforming the salary tax and reviewing customs duties in the near term.

Material increases in revenues can be achieved by making payroll taxes more progressive, subjecting public sector allowances to tax, which can be as large as salaries, and personal income tax being withheld at source.

A review of the customs tariff structure, along with unification of customs regulations with the KRG, and the imposition of new duties (for example, on cigarettes) and sales taxes on luxury goods could also contribute to non-oil revenues.

Targeted technical cooperation in tax policy can help enrich and develop the design of these revenue mobilization measures.

Further improvements in revenue and customs administration could also bring in additional revenue.

The authorities should build on the remarkable progress achieved in the ASYCUDA system trial by expanding its use at other border control points and adjusting customs operations in accordance with the new system.

In the medium term, imposing a general sales tax or value-added tax could boost non-oil revenues.

Third: Monetary policy

The Central Bank of Iraq has resorted to using a tight monetary policy to improve the liquidity management framework, and

further liquidity absorption may be needed to support the monetary policy transition.

In response to the sharp increase in excess liquidity, the central bank raised the policy rate from 4% to about 7.5% and reduced funds for subsidized lending initiatives in mid-2023.

However, the penetration of the policy rate was weak due to excess liquidity and lack of market incentives in financial intermediaries. Especially in government banks.

The reserve requirement was also increased from 15% to 18% and the 14-day CBI billing facility was introduced.

After these measures by the monetary authority, the liquidity surplus decreased initially, but it rose again in August 2023 as a result of the implementation of the general budget,

which means the need for more measures to absorb the liquidity surplus, including improving coordination between fiscal and monetary policy towards achieving The goal of price stability.

As the fiscal policy is expansionary through the huge volume of expenditures, it is offset by a contractionary monetary policy through raising interest rates to confront the surplus liquidity in the economy.

Therefore, consideration can be given to increasing reserve require :heart: ments on government deposits, which will help absorb excess liquidity in government banks without harming private banks.

Organizing and securing correspondent banking relationships is crucial to ensuring an easy transition to the new trade finance system.

The authorities must intensify efforts to modernize the banking sector to facilitate the establishment of correspondent banking relationships.

Trade financing before 2023 was done through financial consolidation, but

after the introduction of the compliance platform, trade financing changed, and the

Iraqi Central Bank pre-financed dollar accounts abroad for local commercial banks that had correspondent banking relationships with Citi Bank for trade financing.

This allowed an increase in the share of cross-border payments settled through commercial banks.

At the beginning of 2025, the Central Bank of Iraq plans to fully transition to a supervisory role in settling cross-border payments (import financing).

To facilitate this transition, the Central Bank of Iraq has assisted private banks in securing correspondent banking relationships, including providing guidance on accrediting and evaluating banks in line with best practices. International.

As of the writing of the article, (6) banks have established correspondent relationships with American banks, and

many others have correspondent banking relationships with non-American banks.

Strengthening these efforts is essential to ensure a successful transition to the new trade finance system.

In addition, monetary policy has achieved an important breakthrough in expanding the scope of digital payments, as

many measures have been taken to promote digital payments, including

expanding the use of point-of-sale devices,

obligating the use of electronic payment cards in certain transactions such as purchasing fuel, and

raising transaction ceilings at ATMs.

Automated bank cards and

reduced bank fees.

These efforts are welcome and will help reduce Iraq's dependence on cash and improve financial inclusion, especially for women whose access to financial services may be restricted due to limited mobility and other obstacles.

Monetary policy also worked to integrate the banking sector, as the

Central Bank took a decision to increase the minimum banking capital requirements from 250 to 400 billion Iraqi dinars.

Banks (many of which are small) will either have to inject more capital or submit an M&A plan by the beginning of 2025, and

careful planning and public communication will be critical to achieving the reform goal of improving the efficiency and competitiveness of the private banking sector without creating a From uncertainty about the banks' viability.

However, the implementation of core banking systems, certification of previous financial statements and amendment of regulations to strengthen the governance of state banks remain weak, and the

slow progress in reforming state banks hampers the effective allocation of credit and transmission of monetary policy.

The authorities must continue to strengthen the AML/CFT framework and its effectiveness, including in the banking sector.

These efforts should be guided by the priority actions emerging from the MENAFATF Mutual Evaluation which will conclude in the third quarter of 2024.

Once key areas for further improvement have been identified, seeking more targeted technical assistance can Helps support these efforts.

views 621 Added 05/17/2024 - 9:59 PM

https://economy-news.net/content.php?id=43504

Home

Home